There are still more than 2 billion unbanked people in the world. These people are excluded from the local and global economy as they still use cash and don't have access to basic financial services. Taking out a loan is a great challenge for them as well unless they obtain a credit history.

MicroMoney’s mission is to solve this problem.

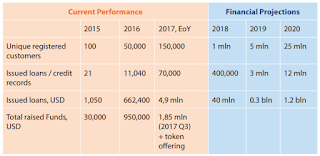

MicroMoney was established as a microfinance institution and has sharpened the business to become a decentralized Open Source Credit & Big Data Bureau on the Blockchain. Since 2015, we provide individuals and SMEs with short-term loans as the best solution for their financial needs. MicroMoney uses innovative risk scoring powered by artificial neural network.

In the long-run, we are able to help 2 billion unbanked and underbanked people to build a multi-purpose digital identity, creditworthiness, and financial reputation. Without borders or intermediaries. Our goal is to bring these people to the new global decentralized crypto economy.

At the same time, we aggregate large sets of data reflecting our customers’ needs and their online behaviour. By sharing and exchanging this Big Data we thus enable banks, financial institutions, e-commerce, and retail businesses worldwide to efficiently scale. They will get access to new customers unserved before, reduce risks while expanding to new markets, and better understand their customers’ needs

According to a McKinsey Report, in 2010 2.5 billion adults, just over half of the world’s adult population, did not use formal financial services to save or borrow. Despite the movement towards financial inclusiveness, in 2017 there are still about 2 billion people in the world without formal banking. That means they are forced to use cash in their daily life and have no chance to address their urgent needs by applying for banking services. Borrowing from friends and family is the most common source of urgent finances because their loan applications are hardly approved by banks. The reason is always the same: they have no credit history. Although financial organizations declare that there are fewer and fewer unbanked each year, those who remain in an unbanked or underbanked status do not have an easy way to solve their situation.

What are the trickiest things for banks to include such people into their customer base?

Unbanked are profitable at large, but they involve higher risks and lower margins. Blockchain

technology offers an answer to classical but outdated banking restrictions. It provides

financial institutions with a way to increase market competition and to make a product

revolution in financial services. The current situation enables and even forces all market

players to provide fast and affordable services for the financially excluded worldwide

MARKET

The Global Problem

As people worldwide lack access to basic financial services, they have limited capacity to overcome poverty and to increase their living standards. That implies a lack of access to both banking services (loans, mortgages, or bank accounts) and access to all other services and opportunities. No credit history means limited access to banking services, which means no loans and, no credit history… However, there is hope to break this vicious circle. There is a large percentage of unbanked individuals in the Asia-Pacific Region, which is now home to more than half of the world’s internet users, 54% of the world’s social media users, and 56% of all mobile social media users. This trend proves that although most Asian people may be unbanked, digital services and innovative solutions have improved people’s lives. And we are here to help bring all those millions of people to the new global crypto economy

Our Solution

MicroMoney is a team of professionals experienced in working in emerging markets. There are 196 countries in the world, and 100 of those countries represent our target market. Who are our potential clients? They are more than 2 billion of unbanked people, they run cash-only households, have no credit history, have no debts, and widely use smartphones and Facebook. They are the so-called “blue collars” and “white collars”, and SMEs. Their monthly income is around $200-500.

This implies a huge amount of new customers and we are here to bring them to the new global crypto economy.

In an emerging market, a smartphone can tell us everything we need about its owner, so that we can estimate his/her creditworthiness. No joke, your smartphone knows you much better than even your best friend.

So we made an app, which gathers 10,000 parameters. We analyze this Big Data using our AI Neural Network Scoring and this is enough to obtain a loan approval decision in just 15 seconds. Now, to borrow money using our app is as easy as to order an Uber. Of course, we are always improving the system too.

We realized that 90% of our customers take the first loan in their life. At the same time, we were overwhelmed by the idea: by providing money to people, we are not just helping to address daily needs. We are helping to create a digital financial identity, to build creditworthiness and reputation and to start their credit history.

And if we want to improve the lives of over two billion people, we must give them access

to the global economy. How?

- Building and Open Source Credit Bureau on Blockchain

- Providing Big Data for Businesses

- Expanding Worldwide

Mission

- Solving hunger and poverty by providing unbanked people with the access to financial services and a possibility to build their first credit history on a Blockchain.

- Helping unbanked small entrepreneurs grow their businesses by offering them online loans.

- Enabling banks, financial companies, einstitutions, and retail businesses worldwide to efficiently scale and serve customers, who previously had no access to their services.

- Creating an extensive micro-financing ecosystem by providing our franchise to local partners.

- Raising financial awareness among our clients by offering consulting services and educational materials.

- Enabling Blockchain companies to efficiently scale their customer base by getting access to our open

- source Credit Bureau with millions of un(der)served people.

- Bringing financially excluded people to the new global crypto economy.

How does the MicroMoney Work?

- Our History: Two years of hard work

MicroMoney was established as a company focused on micro-financing in the money lending industry. We aim to provide the best solution to individuals and SMEs to meet their financial needs. MicroMoney is successfully operating in Cambodia, Myanmar, and Thailand, where our back office is located.

We provide customers with online loans without any collateral requirements. Clients can get the money by just filling in the application form on our mobile app. Using machine learning algorithms, we can approve a loan in just 15 seconds and are able to deliver the funds in 1 hour. After setting up our branch in Cambodia it took only 3 months to make the business profitable. Founded in 2016, MicroMoney Myanmar is equally showing stable performance growth.

Two years of diligent work have resulted in a unique scoring technology, a wide network of business partners, and stable business growth. As for customer feedback, our Facebook page6 reached more than 500 thousand followers, and our app7 in Google Play has a customer rating of 4.8 out 5.

We have more 95,000 registered users, of which 90 percent took out the first loan in their life. About 73% got back to us for a second loan. Currently, our retention statistic show an average of 4.5 social/emergency loans per client.

- Scoring App Powered by Artificial Neural Network

What is an AMM token:

The AMM token is based on a proven risk management and Big Data platform. The token is part of our ecosystem and is used within the platform in different ways. The token serves as the fuel of the MicroMoney ecosystem and has been designed so that our customers will want to use it frequently. It is a token that can and should be bought on exchanges at prevailing market prices

The AMM token provides multiple features within the MicroMoney’s financing platform:

- Partnership access - AMM ownership will give access to advanced platform’s features. For more details, please see the MicroMoney Partnership Program section below.

- Encouragement and rewards - First, borrowers in MicroMoney are rewarded with an AMM bonus for paying back their loans in time while delays cause the AMM bonus to decrease depending on the overdue time. Second, if a borrower has others vouching for him or her and all the payments are made in time, the co-signers will receive AMM tokens as a reward as well.

- Every time MicroMoney receives a payment for personal details, credit history and Big Data, the customer will be rewarded with AMM tokens. This is part of the client's digital reputation. MicroMoney respects personal details of all our clients and will never disclose any information with third parties without consent from the client himself.

- A collateral - AMM can be used as collateral to secure a loan application allowing customers to achieve the lower rates and the other possible privileges and discounts.

- Getting payable access to customer big data & credit histories. Banks, financial and insurance companies, e-commerce, retail and telecom businesses should use tokens to pay for accessing personalised information in the Big Data & Credit Histories Bureau.

- Getting payable access to the Decentralised A.I. Neural Network Scoring system. Banks, financial and insurance companies, e-commerce, retail and telecom businesses should use tokens to pay for the accessing Decentralised A.I. Neural Network Scoring system.

- The right for any contribution to the system to support Sustainable Development Goals. We support SDG program of United Nations: No Poverty, Zero Hunger, Quality Education, Gender Equality, Decent Work and Economic Growth, Reducing Inequalities.

We are growing

A multi trillion dollar business with huge growth potential! The demand for our type of financial inclusion is huge and on the rise. We can add over 7 trillion dollars in annual volume of Global Crypto Economy

Infomation Micromoney

whitepaper: https://www.micromoney.io/MicroMoney_whitepaper_ENG.pdf

Twitter : https://twitter.com/micromoneyio

Facebook : https://web.facebook.com/micromoneymyanmar/?_rdc=1&_rdr

Telegram : https://t.me/micromoneyico

Instagram : https://www.instagram.com/micromoney.io/

stemit https://steemit.com/@micromoney

Whatsapp : https://chat.whatsapp.com/invite/DP5XsCwjd8H0OoY4b4EmD